28+ montana paycheck calculator

Web Montana Paycheck Calculator. Web Montana Income Tax Calculator 2022-2023 If you make 70000 a year living in Montana you will be taxed 11822.

Income Calculators Pay Check Salary Wage Time Sheet

Ad Process Payroll Faster Easier With ADP Payroll.

. Web The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Montana residents only. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Montana a United States western state full of treasures that attract millions of tourists each year.

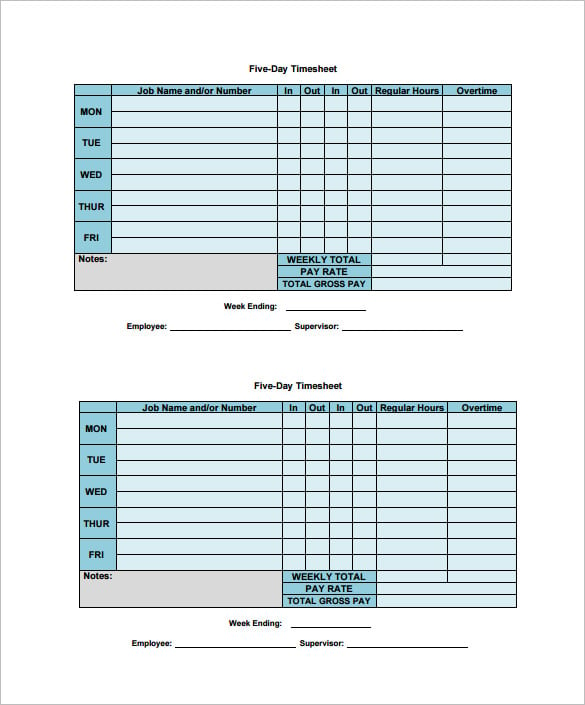

Web By using Netchexs Montana paycheck calculator discover in just a few steps what your anticipated paycheck will look like. Web Calculators Hourly Calculator Montana Montana Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

Web Montana - MT Paycheck Calculator. Use Gustos salary paycheck. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

Web Calculate your Montana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. GetApp has the Tools you need to stay ahead of the competition. Web Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

This free easy to use payroll calculator will calculate your take home pay. Web As an employer in Montana you have to pay unemployment compensation to the state. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Montana Paycheck Calculator Frequently Asked. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad See the Paycheck Tools your competitors are already using - Start Now.

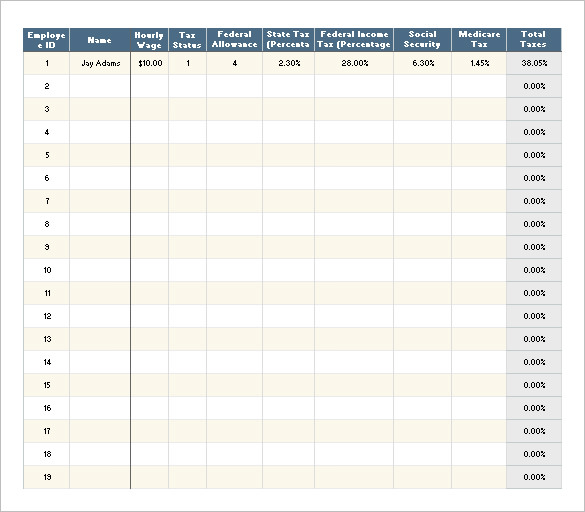

Your average tax rate is 1167 and your marginal tax rate is. Web The state income tax rate in Montana is progressive and ranges from 1 to 675 while federal income tax rates range from 10 to 37 depending on your income. It can also be used to help fill steps 3 and 4 of a W-4.

Supports hourly salary income and. Web Montana Salary Paycheck Calculator Gusto Montana Salary Paycheck and Payroll Calculator Calculating paychecks and need some help. Web Calculating your Montana state income tax is similar to the steps we listed on our Federal paycheck calculator.

The 2023 rates range from 13 to 630 on the first 40500 in wages paid to. It is not a. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Web tool Montana paycheck calculator Payroll Tax Salary Paycheck Calculator Montana Paycheck Calculator Use ADPs Montana Paycheck Calculator to estimate net or. Figure out your filing status work out your adjusted. Get Started With ADP Payroll.

Energy Just Facts

Paycheck Calculator And Salary Calculator Employment Laws Com

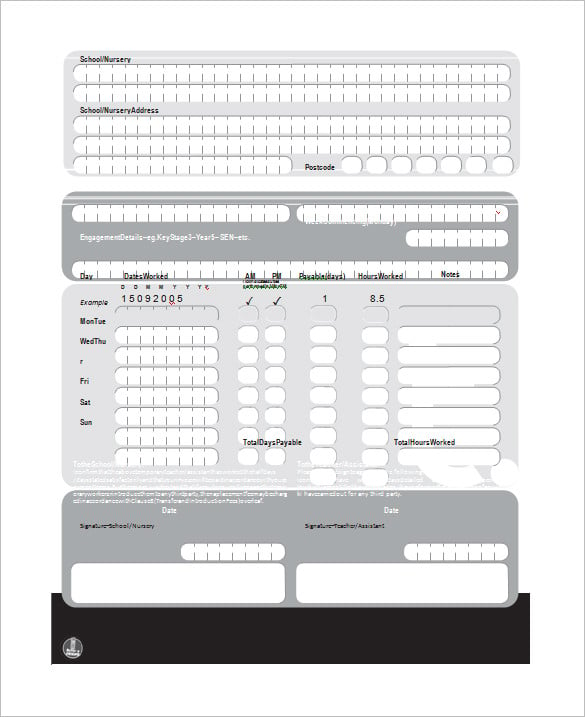

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

8 Salary Paycheck Calculator Doc Excel Pdf

Paycheck Calculator Us Apps On Google Play

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Montana Paycheck Calculator Smartasset

Pdf Does State Merit Based Aid Stem Brain Drain Erik Ness Academia Edu

Paycheck Calculator Apo Bookkeeping

8 Salary Paycheck Calculator Doc Excel Pdf

Calameo Delta County Independent Issue 41 Oct 13 2010

Pdf Remote Sensing And Modeling Applications To Wildland Fires Rehoboth Ifeanyi Erasmus Academia Edu

Paycheck Calculator Take Home Pay Calculator

8 Salary Paycheck Calculator Doc Excel Pdf

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Montana Paycheck Calculator Adp