40+ Extra yearly payment mortgage calculator

Year Interest Paid Capital Paid Mortgage. As an extra our debt to income ratio calculator can give you a solid idea of your recommended debt limits.

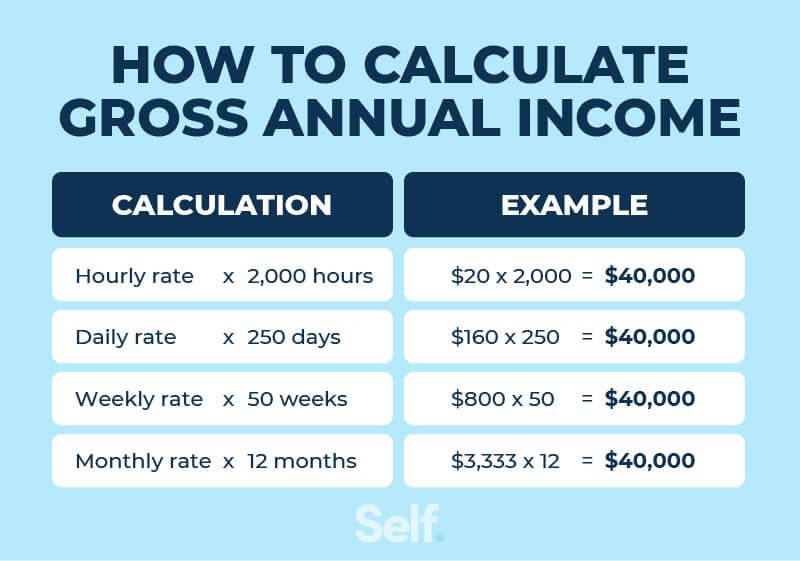

What Is Annual Income And How To Calculate It Self Credit Builder

Yearly Capital Interest Payment Breakdown.

. We offer an advanced mortgage payment calculator to figure monthhly housing expenses. If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and see what your current or. B down payment of 25 to 3499170 of the estimated value of the property.

36740 Nov-6-2028 Payment 75 95483 58620 36863 Dec-6-2028 Payment. But with a good credit record. An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net income is 3000 per month.

Comparing mortgage terms ie. The 30-year mortgage is the most popular choice because it offers the lowest monthly payment. Extra One-time Pay in.

Compare a no-cost vs. Mortgage Amount Capital 212500. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low.

The extra payment options are a one-time. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete. The calculator lets you find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan.

Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. You can check your DTI ratio yearly or quarterly to make sure its within a good level.

C down payment of 35 and up. Should I rent or buy a home. The mortgage calculator with extra payments gives borrowers four ways to include extra payments for their payments in case they want to pay off their mortgage earlier.

Lets say you want to keep your DTI at or below 35. What Mortgage Can I Afford Calculator. There are optional inputs in the Mortgage Calculator to include many extra payments and it can be helpful to compare the.

Check with your mortgage. Should I refinance my mortgage. Additional One-Time Payments.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. To help improve your DTI ratio here are several. Deposit 5 37500.

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Our calculator includes amoritization tables bi-weekly savings. Then the land mortgage monthly payment would be 94394 USD.

What are the tax savings generated by my mortgage. In this the premium payment term is less than the policy term. You can select yearly half-yearly or monthly options to pay premiums.

This mortgage calculator is a well-equipped loan calculator that deals with multiple questions arising when you are about to buy a house with a mortgage loanAs the primal function it enables you to estimate your payment with different loan constructions and compare them alongside its connected costs especially its interest payments. Should I convert to a bi-weekly payment schedule. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

If you dont plan on doing so for 10 20 or 30 years that extra 30 cents has a long time to earn interest. This will keep you around your ideal DTI. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

Lesser lenders willing to approve. Get 247 customer support help when you place a homework help service order with us. To consider how much you can afford in a mortgage payment multiply your comfortable DTI by your gross monthly income.

Extra Payment Mortgage Calculator. Ideally youll want to spend a total of around 2800 per month on your mortgage payment. This option allows assured to pay the complete premium amount at one time when you purchase the plan.

So lets use the 401k calculator to show you how. For example lets say you are 40 years old and plan on retiring at the age of 67. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

However the trade-off for that low payment is a significantly higher overall cost because the extra. 1200 100 per month. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

This calculator assumes that no premium is charged when the down payment is over 20. The loan is secured on the borrowers property through a process. Account for interest rates and break down payments in an easy to use amortization schedule.

Assured can make recurring payments for a pre-decided limited time. After that we can consider for example a land value of 150000 USD a down payment of 15000 USD monthly payment frequency 30 years loan length and an interest rate of 75. Initial interest Rate APR 2.

060 of the estimated value of the property. Use our free mortgage calculator to estimate your monthly mortgage payments. Extra Yearly Pay from.

240 of the estimated value of the property. Check out the webs best free mortgage calculator to save money on your home loan today. 8000 35 2800.

A down payment of 20 to 2499. If you are considering making extra payments on a loan it is typically best to make them early in the loan term as debt that is. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25 years insurance or Fannie Mae loans up to 30 years or FHA loans up to 35 years for refinance or 40 years for construction to permanent financing. Eventually you will pay income taxes on it but only when you withdraw it. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Heres how much your monthly mortgage payment will cost. 15 20 30 year Should I pay discount points for a lower interest rate. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Yearly - If your down payment is less than 20 you are.

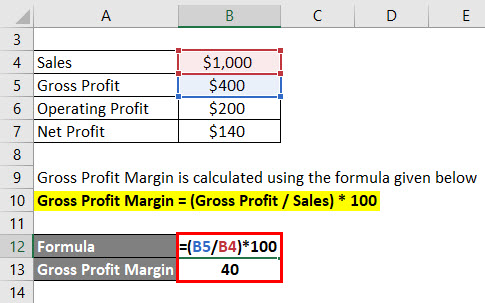

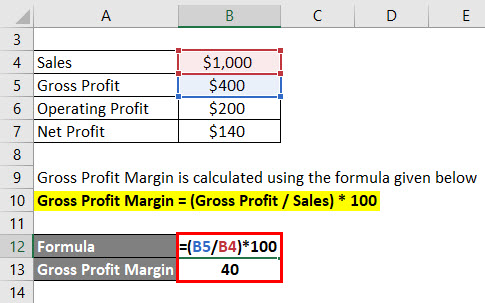

Income Statement Formula Calculate Income Statement Excel Template

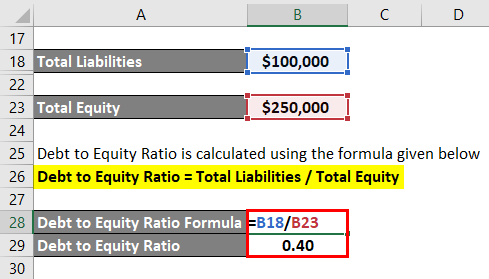

Debt To Equity Ratio Formula Calculator Examples With Excel Template

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

2

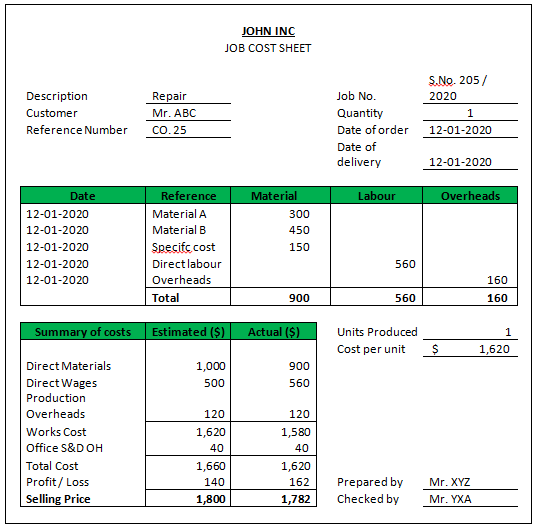

Job Costing Complete Guide On Job Costing In Detail

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

Amortization Schedule Excel Amortization Schedule Schedule Templates Schedule Template

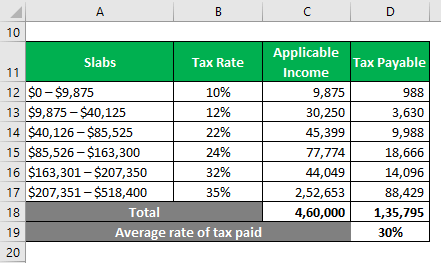

Progressive Tax A Complete Guide On Progressive Tax In Detail

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

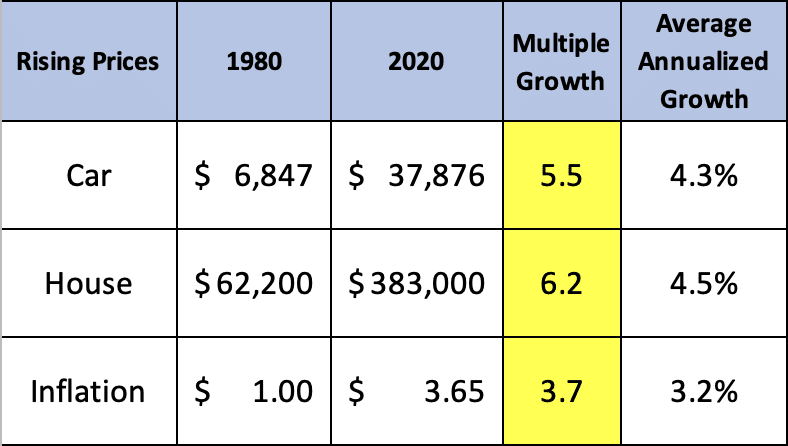

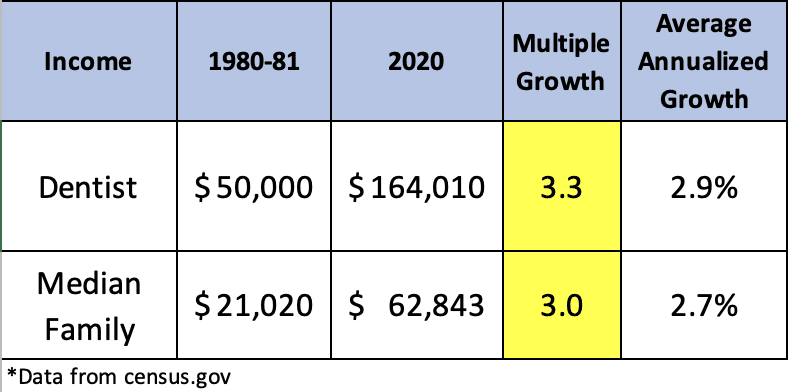

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

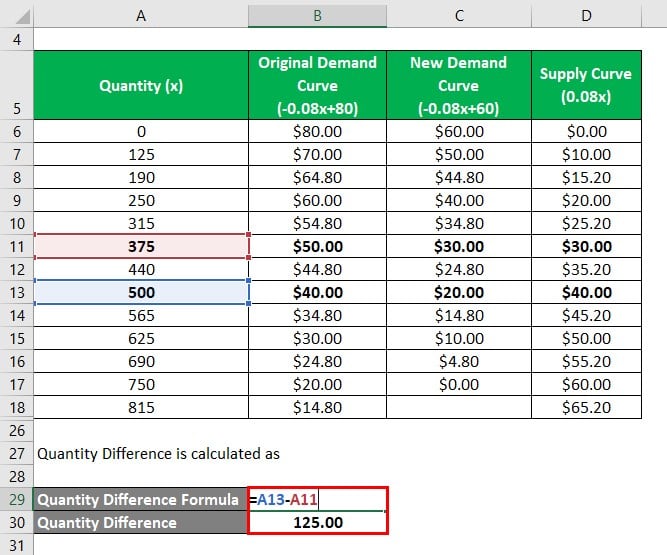

Deadweight Loss Formula How To Calculate Deadweight Loss

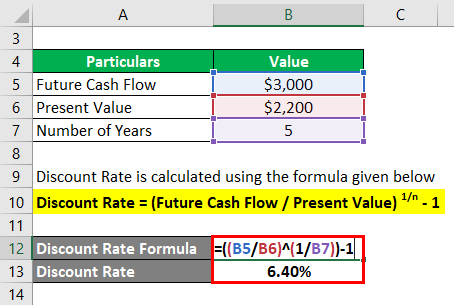

Discount Rate Formula How To Calculate Discount Rate With Examples

How Much Savings Should I Have By 40 A Retirement Savings Guide

How Much Savings Should I Have By 40 A Retirement Savings Guide

How Dental School Costs Have Changed Over 40 Years Student Loan Planner